Passenger cars continue to underpin the industry, accounting for 72.4% of revenue, and internal combustion engines also lead, but momentum is building in electric vehicles, with a 4.25% CAGR by 2030.

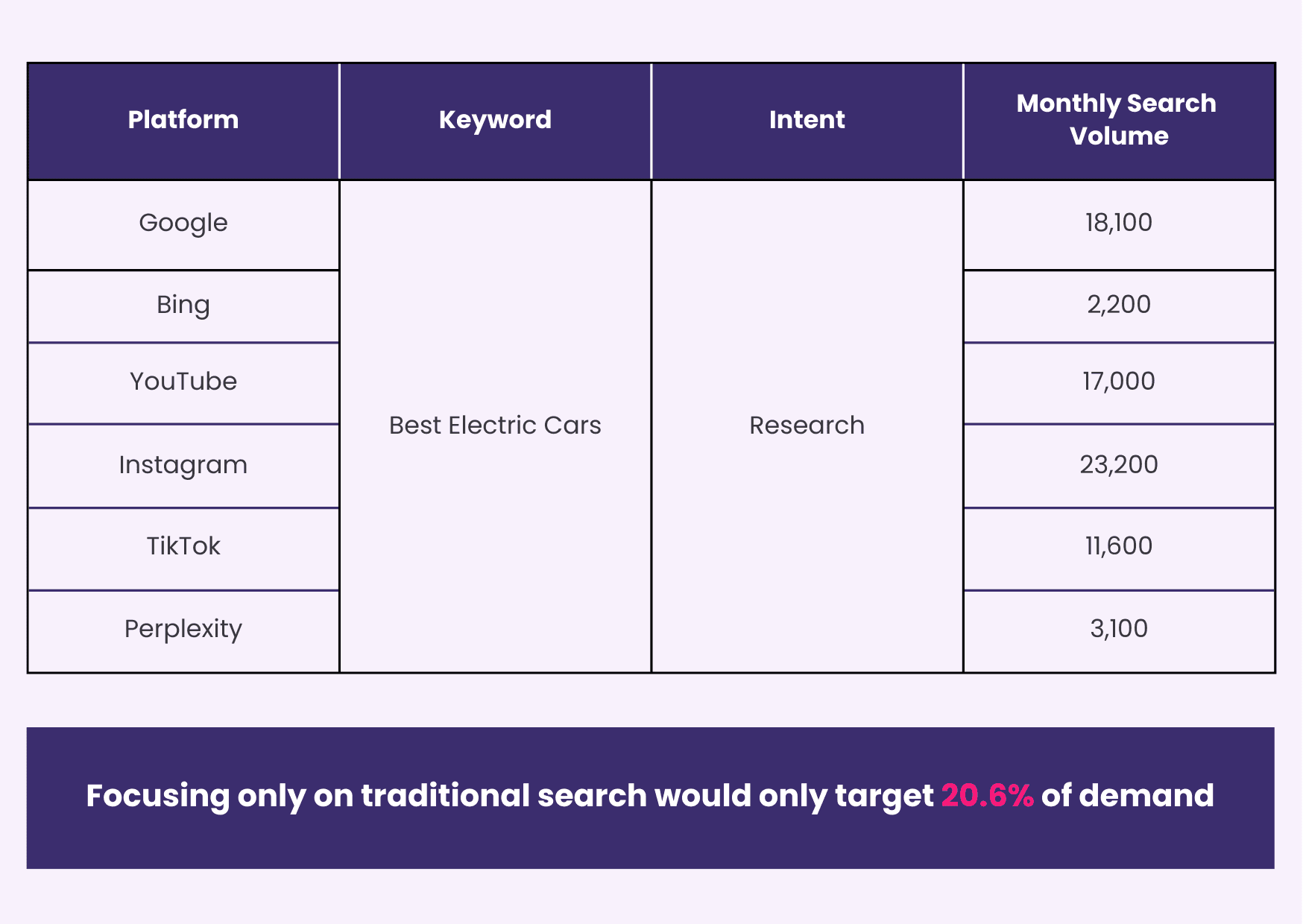

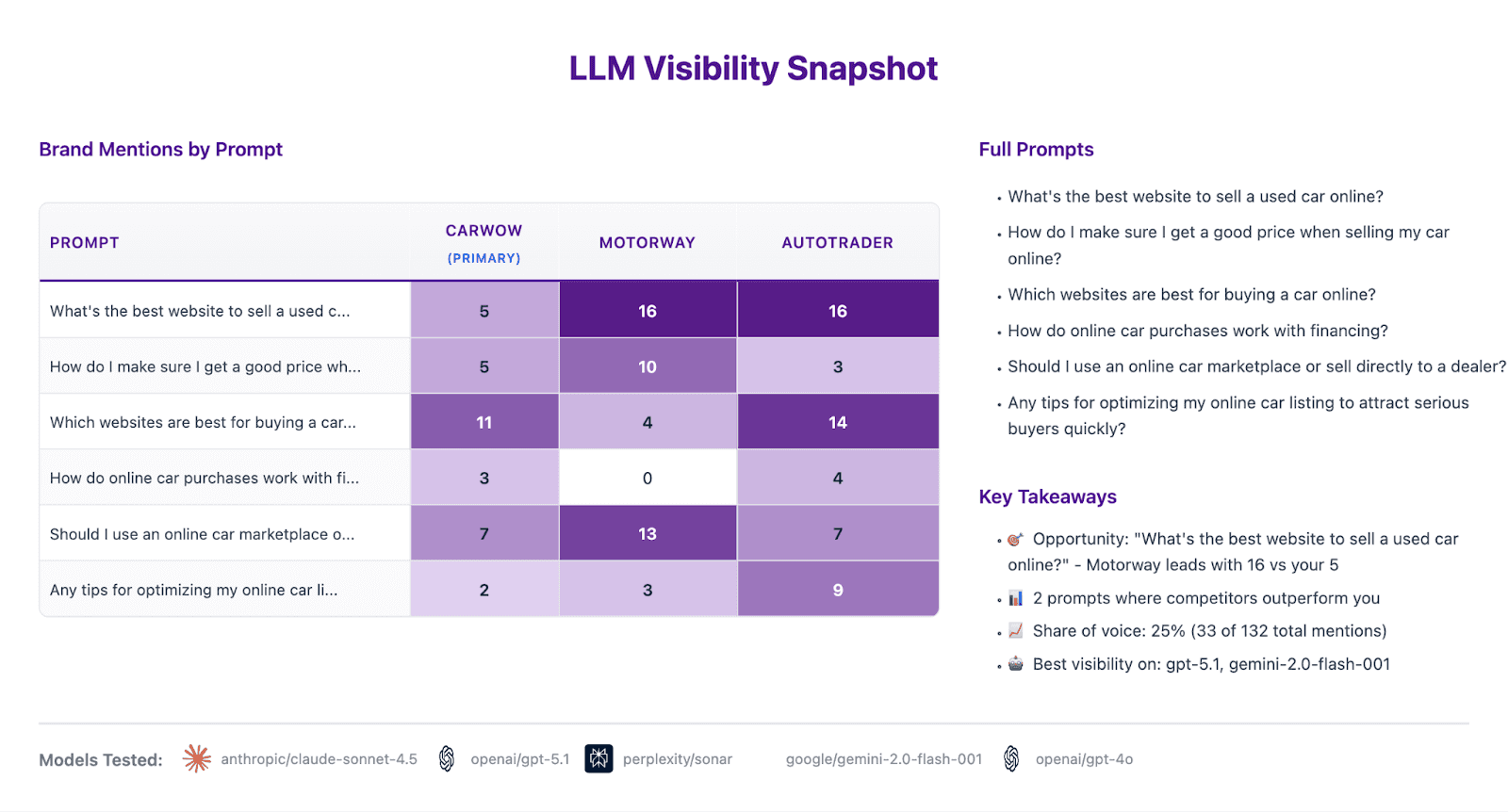

This reflects the idea that large-scale transition will take some time, but the shift is already affecting regulations and product and marketing strategies. Zero Emission Vehicle (ZEV) targets have shifted the market back to a ‘push’ environment, where brands need to actively sell to reach consumers.

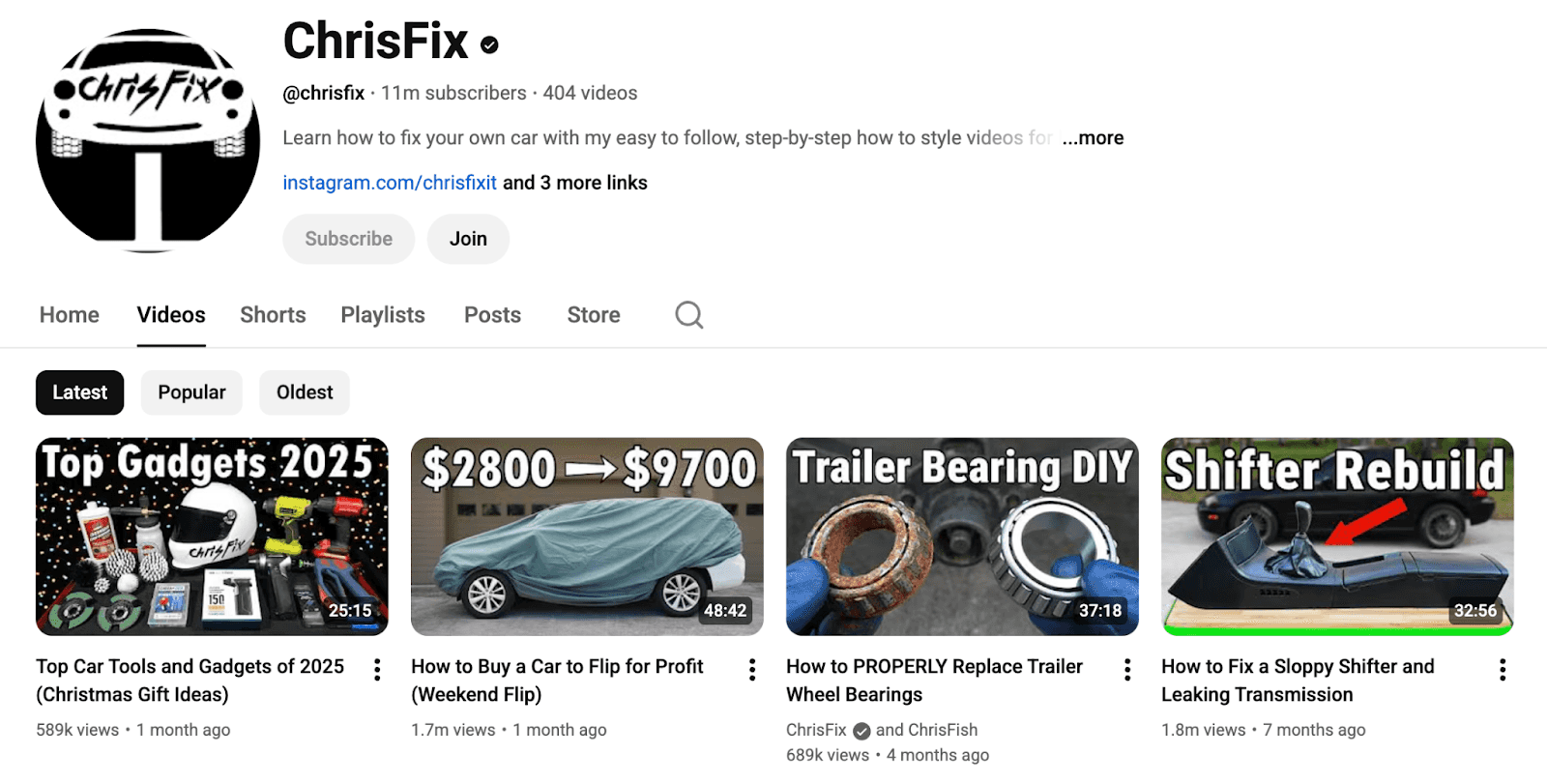

Data shows that most people still buy their own vehicles, but there’s been an increase in flexible alternatives and subscription models, as consumers look for lower upfront cost, lower commitment, and greater ease of switching to newer models. User car demand is still going strong, and online engagement and speed of scale are at record levels.